MARKET UPDATES FROM MACDONALD REALTY

September Market Update

In March, 2009, in the midst of the Global Financial Crisis and the collapse of the Canadian housing market, we made a bold prediction: The Canadian housing market would rebound quickly and not suffer a US-style collapse.

Here is what we wrote:

"As many of you may know, the US housing market has been in a severe recession for the past several years. And while the Canadian housing market has recently seen a strong correction over the past 6 months, we will likely not see the same year-over-year pain as our neighbours to the south.

There are 3 main reasons for this.

1. Government Tax Policies

2. Loan Qualification Policies

3. Bank Lending Policies

Government Tax Policies

The US Government has long had a policy of encouraging home-ownership. Government-sponsored entities Fanny Mae and Freddy Mac have been getting most of the headlines recently for agreeing to purchase mortgage loans that encouraged unsound lending. However, the US Government's tax policy of allowing homeowners to deduct mortgage interest payments may be more significant, as it has encouraged Americans to maximize their debt-loads in order to minimize their tax burdens.

Canada, of course, has no mortgage tax break for homeowners, with interest payment deductions only applying to investment properties.

Loan Qualification Policies

The secondary mortgage market in the US allowed the originators of mortgages to pass on the mortgage notes to investors throughout the world. Because of this, lenders became incentivized to originate as many mortgages as possible, with little-to-no regard for risk. These perverse incentives led to 'liar loans' - where individuals would simply lie to their mortgage broker about their income or employment knowing that there would be no incentive to conduct a background check - and 'NINJA loans' - where mortgage brokers offered mortgages to individuals with No Income, No Job or Assets.

In Canada, the originators of loans (typically the Big Banks) tend to hold on to them. Because of this, the correct incentives are in place to ensure that only individuals who can afford the mortgage receive them.

Bank Lending Policies

Another unintended consequence of the secondary mortgage market in the US has been the creation of extensive Adjustable-Rate Mortgage products with attractive 'teaser' rates. These products allowed mortgage-holders to pay an unrealistically low rate for a period of time before 'resetting' to a much higher, unaffordable, rate.

In addition to this, loans in the US tend to be 'non-recourse' meaning that the only collateral that a lender would have on a mortgage is the house itself. In Canada, mortgages tend to be 'full-recourse', with many banks demanding personal guarantees. This difference has resulted in people walking away from their homes in the US at a much higher rate than in Canada.

In the end, the result of all of these policy differences means that Canada is fairly well-insulated from the carnage that is occurring south of the border. Interestingly, our conservative, low-competition banking environment may have saved our housing market from an even more painful downturn."

Once again, two competing views have emerged in the wake of higher Canadian real estate prices. Last Week the Canadian Centre for Policy Alternatives wrote we are primed for a correction while the CD Howe Institute wrote that the headwinds facing the US housing market are completely different from the ones we are facing in Canada.

The CCPA report ignores all of the issues that we presented over a year ago while the CD Howe report covers them in length.

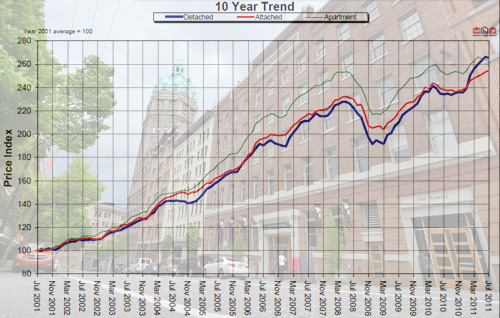

That said, for the foreseeable future, the huge real estate run-ups that we have experienced over the past decade are most likely over. There will always be ups and downs in the real estate market. However, real estate in Canada will remain, relative to most other investment vehicles, one of the more stable financial instruments moving forward.

Remember, real estate trends remain decidedly local. If you would like to find out more about your market, please feel free to contact me at the email address or phone number above.

*This communication is not intended to cause or induce breach of an existing agency agreement.

*Although this information has been received from sources deemed reliable, we assume no responsibility for its accuracy, and without offering advice, make this submission to prior sale or lease, change in price or terms, and withdrawal without notice.

PRE-SALE CONDO MARKET

PRE-SALE CONDO MARKET MORTGAGE NEWS AND RATES

MORTGAGE NEWS AND RATES

The amount of added inventory and no extra buyer demand has left Vancouver attached properties (Apartments/Lofts/Townhouses/Duplexes) in a buyer's market. Demand remains consistent with strong sales numbers in June 2010 (1258 units) and the inventory to supply this demand is currently well.

The amount of added inventory and no extra buyer demand has left Vancouver attached properties (Apartments/Lofts/Townhouses/Duplexes) in a buyer's market. Demand remains consistent with strong sales numbers in June 2010 (1258 units) and the inventory to supply this demand is currently well.